- August 11, 2025

- Posted by: wp_update-1695559536

- Category: News

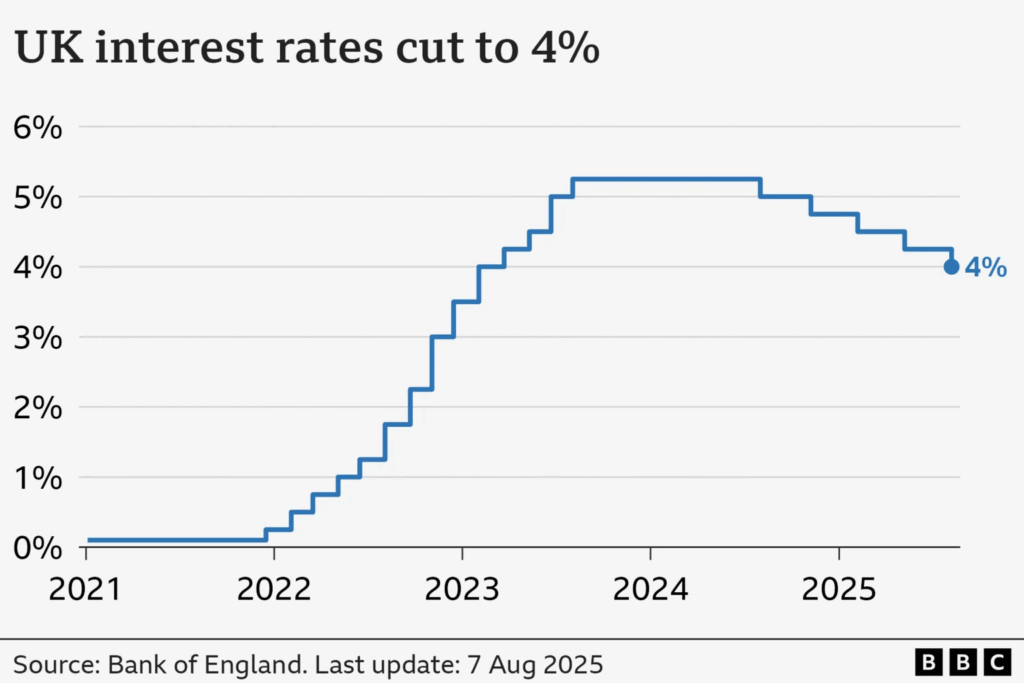

The Bank of England has reduced its base interest rate from 4.25% to 4.0%, marking its lowest level in more than two years and the first cut since March 2023. This move, decided by a narrow margin among policymakers, aims to provide relief for borrowers as inflation remains above target.

Homeowners with tracker and variable-rate mortgages are expected to benefit from lower monthly payments, though savers may see reduced returns. The central bank now forecasts inflation to peak at around 4% in September 2025, higher than previously expected but still on track to gradually decline.

Governor Andrew Bailey noted that while the economy has shown resilience, pressures from rising food prices, higher wages, and adverse global weather conditions continue to weigh on household budgets. Businesses, particularly in retail and hospitality, are also facing challenges as consumers shift to cheaper options and reduce discretionary spending.

Future rate cuts will be considered cautiously, depending on incoming economic data and the pace of inflation’s decline.

Source BBC News