- September 30, 2025

- Posted by: wp_update-1695559536

- Category: News

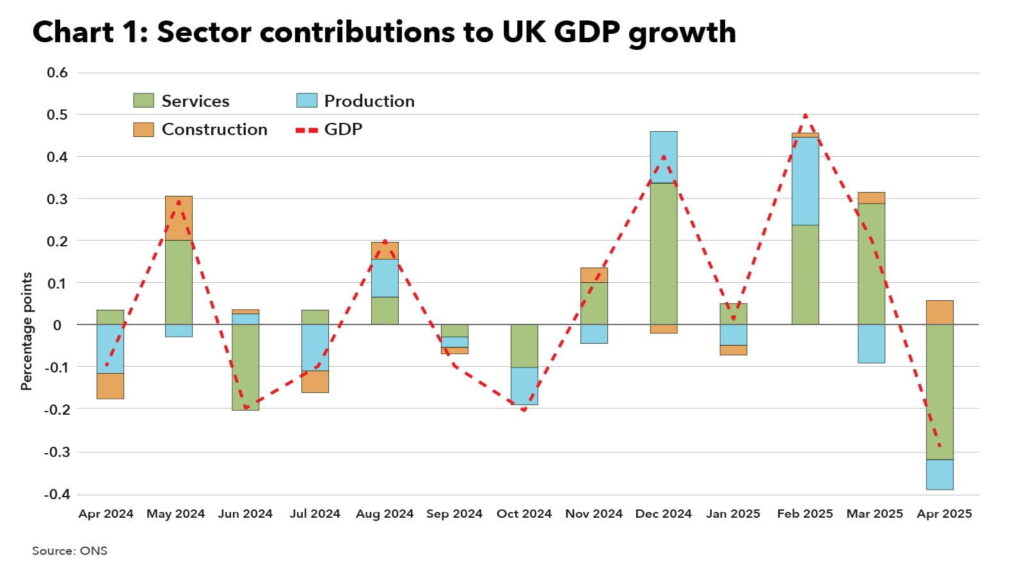

UK’s GDP grew by 0.3% in the second quarter of 2025 (April to June), indicating a slowdown from the 0.7% growth in the first quarter. This slowdown partly reflects some activity being brought forward earlier in the year, such as house purchases before a stamp duty rise. Despite the growth, production overall fell by 0.8%, with declines in metals, manufacturing, and food and beverage sectors, raising concerns for industrial output.

Inflation remains a key issue, with consumer price inflation at 3.8% in August 2025, driven largely by food price increases. The UK is forecast to have the highest inflation rate among G7 nations this year, at around 3.5%, according to the OECD. The Bank of England expects inflation to peak at about 4% before gradually declining.

Government borrowing is lower than expected for July 2025, but tax rises are still anticipated in the upcoming Autumn Budget as Chancellor Rachel Reeves aims to adhere to fiscal rules despite “harsh global headwinds” hampering growth. The UK economy is facing challenges from fragile demand, rising inflation, and global uncertainties, although some sectors like pharmaceuticals and information services have seen growth.

Overall, the UK economy shows modest growth with persistent inflation and production sector challenges, while fiscal pressures prompt expectations of tax increases later this year.